For many companies — especially mid-sized companies — commercial insurance can be a difficult and complex challenge. Conventional insurance brings with it a frustrating lack of transparency and control over premiums, claims processes, and overall costs. Since Captive Resources’ (CRI) inception, our team has understood the impact that lack of control can have on a company’s financial outlook and employee safety.

It was the lack of control inherent in conventional insurance programs that inspired CRI’s co-founders to create the first iteration of our member-owned group captive model. Facing a hard insurance market and growing premiums (despite a commendable loss record), business owner Karl von Heimburg teamed up with his then-insurance broker, George Rusu, to form one of the first group captive insurance companies in the mid-1980s.

Over the decades, CRI has continued to evolve our member-owned group captive model to provide companies with an otherwise unobtainable control over premiums, claims, and coverage — all while creating opportunities to improve employee safety and return underwriting profit to the insured member-owner companies.

Common Options for Managing Risk

To explain how CRI’s member-owned group captive model offers companies greater control over their insurance destiny, it helps to briefly review common methods your company could choose to manage risk:

Conventional Guaranteed-Cost Insurance

One of the most commonly known methods for managing risk is guaranteed cost commercial insurance. In this traditional insurance arrangement, a company (i.e., the insured) pays a premium to transfer all its risk to an insurance carrier that agrees to pay covered claims up to a specified amount. The insured retains little, if any control over its insurance program, relying on the insurer to administer claims and provide support services.

Self-Insurance

Companies that self-insure retain all of their risk. While self-insurance allows companies to maintain greater control than conventional insurance, this method can be unpredictable and leave companies vulnerable to catastrophic loss (in the absence of excess insurance). In addition, unless companies have considerable in-house resources and expertise, provisions must be made for actuarial services to provide loss funding estimates and for claims management, legal, and other support services. Therefore, this solution is often utilized by Fortune 500 and other companies that have the resources to devote to financing and managing a program.

Risk Management

This solution is a blend of traditional commercial insurance and self-insurance, whereby insureds typically retain their predictable losses while transferring catastrophic losses to an insurer. This option allows companies to retain some control of their insurance program while minimizing exposure to catastrophic loss. One of the most common forms of this blended approach is a large deductible plan wherein the insured retains a portion of each loss via an often substantial per claim deductible (e.g., $50,000, $100,000, $250,000) and transfers loss in excess of the deductible to the insurer. For an additional cost, the insurer often manages the claims which fall within the deductible, which may limit the insured’s control over claims adjudication.

The Group Captive Option

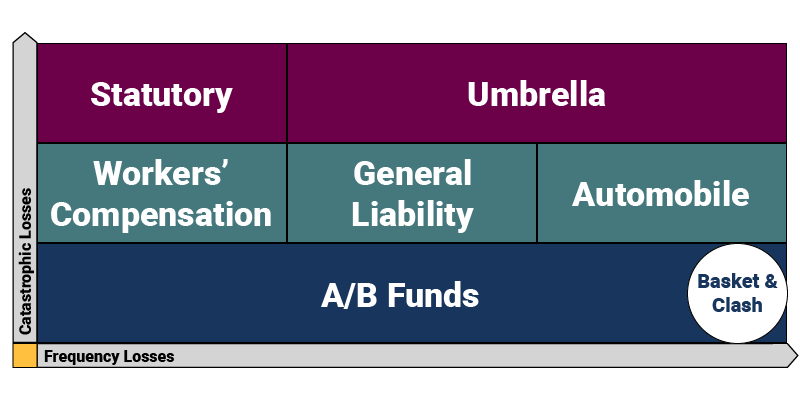

Our member-owned group captive model — and captive insurance as a whole — falls into the risk management category. At a high-level, a captive is an insurance company that provides insurance to and is controlled by its owners. The key to this definition is “control.” By choosing to be owners of an insurance company — rather than buyers of an insurance policy — captive owners can take control of premiums, claims, coverage, and other facets of their commercial insurance.

There are several different types of captives. At first, the industry was dominated by single-parent captives — a captive that insures only the risks of its sole owner or parent company and its affiliates. The single-parent structure is typically best-suited for large companies with complex and/or multinational risks. We introduced our member-owned group captive model so smaller companies could enjoy the same control and other benefits of captive insurance, even if they didn’t have the scale required for a single-parent captive.

Within the group captive industry, our model offers members even more control. Unlike other programs with external stakeholders like brokers or carriers, the member-owned group captives we work with do not allow any external ownership. This means each captive we provide our consultation services is wholly owned and operated by the companies that it insures.

Here’s what our model means for member-companies:

Opportunity for Lower Total Cost of Risk

Individual member companies’ premium is based on their own 5-year loss experience, meaning more accurate initial pricing. Members can continually lower their premiums over time by controlling their losses. In addition, dividends are received for unused loss funds, as well as the investment income earned on those funds and capital and cash collateral.

Control Over Operations

Group captive member-companies (the insureds) are the sole owners of the captive. In addition, they are equal owners of their insurance company — regardless of premium size, each member has one seat and one vote on the captive’s board of directors.

Customized Coverages that Fit Unique Needs

Group captives provide common commercial coverages like workers’ compensation (WC), general liability, automobile, medical stop loss, and even property. We help the captives work with the policy issuing carrier to customize coverage according to the members’ specific needs.

Opportunities to Participate and Collaborate

Each captive utilizes a committee structure with active participation among members. The committees, comprised entirely of member representatives, oversee critical captive functions like finance and investment, underwriting, and risk control. The committees bring their recommendations to the entire Board for consideration and approval.

A Unique and Proven Risk Funding Formula

Our pioneering model utilizes a funding formula referred to as the A/B Fund formula, which helps members to understand how premiums are determined and also provides transparency with respect to the captive’s expenses. This model has become an industry standard.

Industry-Leading Risk Control and Safety Services and Resources

The group captives we work with only admit best-in-class companies and ensure each member remains committed to risk and claims management. To help companies maintain their commitment to safety and continuous improvement, captives provide member companies access to an array of risk management resources and support services, including risk control workshops, webinars, membership in the National Safety Council, and much more.

Exclusive Investment Opportunities

Only captives that work with CRI are able to invest their assets in an investment fund, a highly successful, well-established mutual fund formed by CRI over 25 years ago specifically to meet the unique investment needs of group captives.

Member-Owned Group Captive Professional Support

Like conventional insurance companies, group captives require a variety of expertise and support to operate efficiently and effectively. Captives have virtually all of the same functional areas of a traditional insurance company, but they don’t have employees. To fulfill those responsibilities, the captives outsource support like policy issuance, actuarial services, claims administration, loss prevention, and financial auditing. These services are unbundled, allowing the captive to make changes to its services more easily with lower cost or disruption. The following are the professionals that play a major role in our member-owned group captive model:

Captive Consultant

CRI is an independent group captive consultant reporting directly to the captive Board of Directors. In this capacity, we provide a dedicated team to fulfill a variety of responsibilities for the captive, including:

- Program Management: Facilitates the day-to-day needs of the captive and its individual members and their brokers, reporting, and new member onboarding.

- Risk Control: Supports the captives and their member-companies’ efforts to minimize loss and improve workplace safety, measure results, and continually improve.

- Claims Services: Oversees and provides quality assurance on members’ claims services, offers claims advocacy, and assists in complex claim strategies.

- Finance: Provides financial and investment advice.

- Meeting Management: Coordinates and facilitates semi-annual board meetings and other on-site events.

CRI is also responsible for the coordination of all service providers to the captive:

Insurance Broker

Insurance brokers are integral to the captive and introduce and educate prospective member-companies about the mechanics of group captive insurance. They assist their captive member clients with:

- Coordination of policy issuance

- Billing and premium collection

- Insurance support services, such as certificates of insurance and vehicle I.D. card issuance

- Loss/claim assistance

- Placement of coverages not provided by the captive

- Annual coverage renewal

Policy-Issuance (“Fronting”) Company

U.S.-licensed, admitted, and rated insurance carriers issue full policies to the captive members and assume the full financial risks of each program. The captive reinsures the fronting company up to the captive’s retention.

Captive Manager

The Captive Manager is responsible for the day-to-day operations of the captive, including overseeing governance, regulatory reporting, cash management and accounting, audit, and tax coordination, providing the registered office, and corporate secretarial functions including compliance. Our sister company, Kensington Management Group, Ltd., the largest independent captive management firm in the Cayman Islands, provides these services to most of the captives we work with.

Third-Party Claims Administrator (TPA)

The captive employs an independent contractor to negotiate and settle all claims against its shareholder insureds. The captives we support partner with the leading providers of technology-enabled claims management services. Tech-based tools and solutions are made available to captive members to support their active involvement in managing their claims.

Independent Loss Prevention Consultant

Within their own companies, captive members place serious emphasis on good loss prevention practices. Members realize that through good loss prevention, claims can be prevented, which helps lower costs. Loss prevention consultants are hired as independent contractors by the captive or individual member companies. They periodically visit each member’s facilities to help achieve the captive’s loss prevention and safety standards.

Actuary

The actuarial firm, as an independent contractor, takes loss data supplied by the captive member and compiled by the broker and, after trending and developing this data, sets a “loss pick” for each member upon which the member’s final premium is based.

Auditor

While the financial reports are prepared by the Cayman Islands manager, Kensington Management Group, they are independently audited in accordance with U.S. generally accepted auditing standards.